Understanding Cryptocurrency Mining

Cryptocurrency mining is a crucial process in the functioning of many cryptocurrencies, especially those that use a proof-of-work (PoW) consensus mechanism, like Bitcoin and Ethereum (prior to its transition to proof-of-stake). Mining not only secures the network but also generates new coins, making it an integral part of the cryptocurrency ecosystem.

What is Cryptocurrency Mining?

At its core, cryptocurrency mining is the process of validating transactions and adding them to the blockchain, the decentralized ledger that records all transactions in a cryptocurrency network. Miners use powerful computers to solve complex mathematical problems, which helps maintain the integrity and security of the blockchain. When a miner successfully solves a problem, they create a new block of transactions that is added to the blockchain, and in return, they receive a reward in the form of cryptocurrency.

The Mining Process

- Transaction Verification: When users make transactions, these transactions are sent to the network, where they await confirmation. Miners group these transactions into a block.

- Solving the Cryptographic Puzzle: Each block has a unique cryptographic hash that must be solved. Miners use their computing power to find a hash that meets certain criteria set by the network, which requires significant computational effort and energy consumption.

- Adding the Block: Once a miner finds a valid hash, they broadcast it to the network. Other miners and nodes verify the hash and the transactions within the block. If everything checks out, the block is added to the blockchain, and the miner receives a reward.

- Rewards: The reward for mining a block typically consists of two components: the block reward (newly created coins) and transaction fees from the transactions included in the block. The block reward decreases over time (e.g., Bitcoin undergoes a “halving” every four years), which is designed to control the supply and inflation of the cryptocurrency.

Types of Mining

- Solo Mining: In solo mining, an individual miner operates independently and attempts to mine blocks on their own. This method requires significant computational resources and is less likely to yield rewards compared to pooled mining due to the increased difficulty of solving blocks.

- Pooled Mining: Most miners today participate in mining pools, where multiple miners combine their computational resources to increase their chances of successfully mining a block. Rewards are distributed among pool members based on their contribution to the mining effort.

- Cloud Mining: Cloud mining allows users to rent mining power from remote data centers. This method is appealing for those who may not have the resources to set up and maintain their own mining rigs. However, it comes with its own risks, including potential scams.

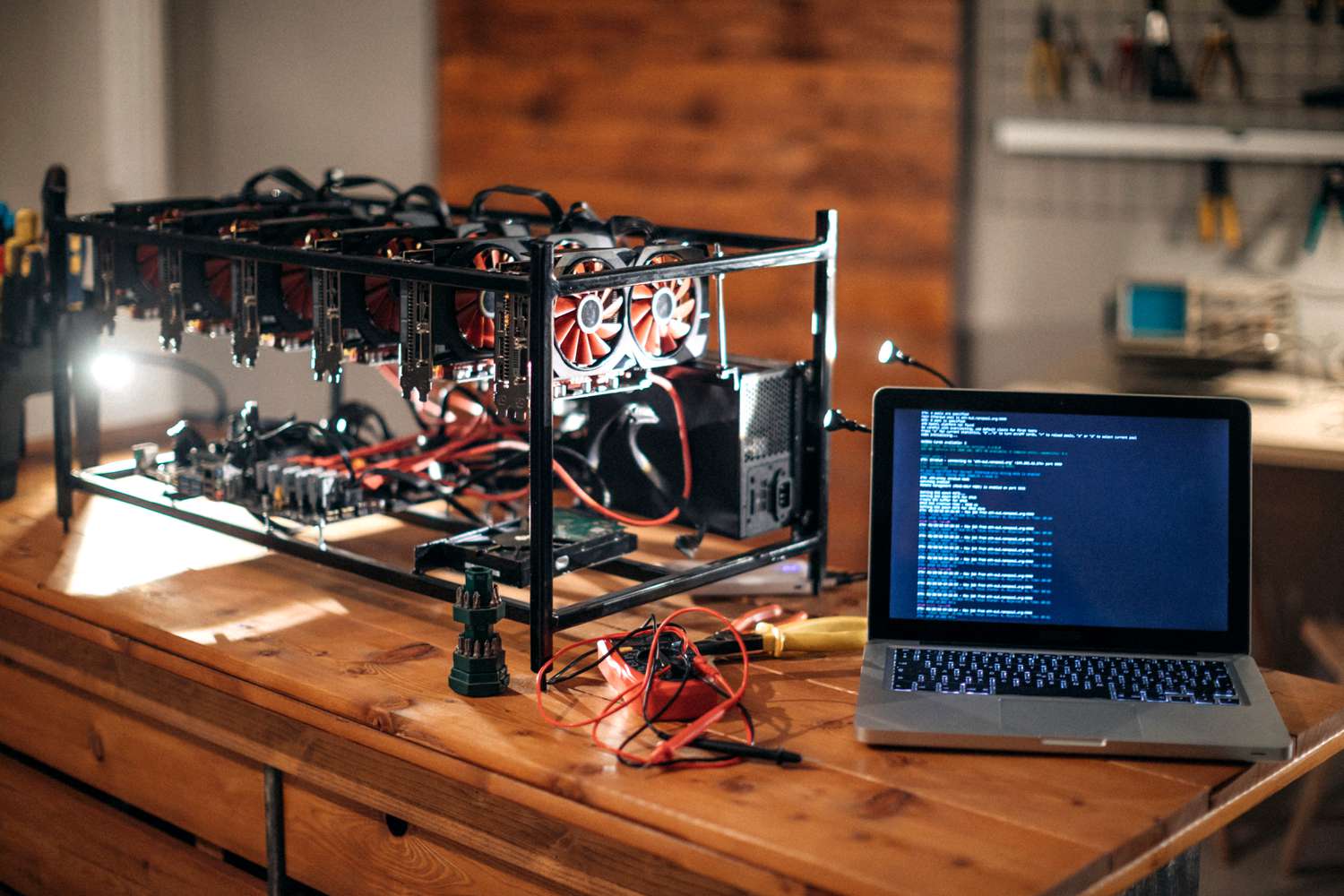

Hardware and Software Requirements

Mining requires specialized hardware and software:

- Mining Hardware: Early miners used standard CPUs, then transitioned to GPUs (graphics processing units). Nowadays, ASICs (Application-Specific Integrated Circuits) are the most efficient mining hardware, specifically designed for mining cryptocurrencies.

- Mining Software: Various mining software options are available, which connect miners to the blockchain and manage their mining activities. Popular options include CGMiner, BFGMiner, and EasyMiner.

Energy Consumption and Environmental Concerns

Cryptocurrency mining has garnered significant attention for its high energy consumption. Bitcoin mining, in particular, consumes as much energy as some small countries. This has raised concerns regarding its environmental impact, especially when fossil fuels are used as the primary energy source.

Efforts are being made to mitigate these concerns:

- Renewable Energy: Many miners are turning to renewable energy sources like solar, wind, and hydroelectric power to reduce their carbon footprint.

- Transition to Proof-of-Stake: Some cryptocurrencies are shifting to less energy-intensive consensus mechanisms, such as proof-of-stake (PoS), which does not require intensive computational efforts.

The Future of Mining

The future of cryptocurrency mining is likely to be shaped by several factors:

- Regulatory Developments: Governments around the world are exploring regulations to manage the environmental impact and economic implications of mining. Changes in regulatory frameworks could significantly affect the mining landscape.

- Technological Advancements: As technology advances, more efficient mining hardware and software solutions are expected to emerge, which could enhance energy efficiency and lower costs.

- Market Dynamics: The profitability of mining is influenced by cryptocurrency prices, mining difficulty, and competition among miners. As more individuals and institutions enter the space, these dynamics may continue to evolve.

- Diversification of Consensus Mechanisms: The industry is seeing a gradual shift towards various consensus mechanisms beyond PoW, including PoS, delegated proof-of-stake (DPoS), and proof-of-authority (PoA). This shift could change the landscape of how transactions are validated and how miners operate.

Conclusion

Cryptocurrency mining plays a vital role in maintaining the security and integrity of blockchain networks. While it offers opportunities for profit and engagement in the digital economy, it also raises important questions about energy consumption and environmental impact. As the cryptocurrency space evolves, so too will the practices, technologies, and regulations surrounding mining. Understanding these dynamics is crucial for anyone looking to engage with or invest in the world of cryptocurrencies. Whether you’re a miner, investor, or enthusiast, staying informed about the trends and developments in mining will be essential for navigating this ever-changing landscape.