In today’s digital world, smartphones have become more than just communication devices. They’ve transformed into essential tools for managing finances, shopping, and even making payments. One of the most significant innovations in mobile technology is the ability to use your Android phone as a credit card. With the advent of mobile payment services, NFC (Near Field Communication) technology, and secure digital wallets, your Android phone can now function as a virtual credit card for a wide variety of transactions. This guide explores how to use Android as a credit card, the benefits, security features, and the steps involved in setting up and using mobile payments.

What Does It Mean to Use Android as a Credit Card?

To use Android as a credit card, you essentially convert your phone into a payment tool. This is done by adding your credit card details to a mobile wallet or payment app that supports digital transactions. Once your card is set up, you can use your phone to make in-store, online, and even peer-to-peer payments, just as you would with a physical credit card.

Android devices, through various apps and services like Google Pay, Samsung Pay, and others, offer a simple and secure way to carry out payments without needing to physically swipe or insert a card. This ability to use your Android phone for payments is particularly convenient, reducing the need to carry a bulky wallet full of cards.

How Does Android Function as a Credit Card?

When you use an Android phone for credit card transactions, the phone essentially acts as a virtual version of the credit card. This is made possible through technologies like NFC and secure payment apps. Here’s how it works:

- NFC Technology: Most Android phones are equipped with NFC technology, which allows the phone to communicate wirelessly with payment terminals. When you tap your phone on an NFC-enabled point-of-sale terminal, it transmits the payment information securely, just as if you were swiping or tapping a physical credit card.

- Payment Apps: Android phones support various mobile payment platforms, including Google Pay, Samsung Pay, and PayPal. These apps securely store your credit card, debit card, and other payment details, allowing you to make purchases using your phone.

- Tokenization: To protect your financial information, mobile wallets use tokenization, a process that replaces sensitive card details with a unique, encrypted identifier (token). This token is used for the transaction instead of your actual credit card number, ensuring your data stays secure during the payment process.

- QR Code Payments: In addition to NFC, Android phones can also be used for payments via QR codes. Some payment apps allow you to scan a merchant’s QR code to make payments directly from your credit card or linked bank account.

How to Set Up Android as a Credit Card

The process of setting up your Android phone as a credit card is straightforward and involves just a few steps. Here’s a guide on how to get started:

1. Choose a Mobile Payment App

To use Android as a credit card, you need to first choose a mobile payment app that supports the feature. Some of the most popular options include:

- Google Pay: A widely used mobile wallet that works with a variety of credit and debit cards, including major brands like Visa, Mastercard, and American Express. Google Pay can be used for both in-store and online payments.

- Samsung Pay: A payment system exclusive to Samsung devices that supports both NFC and MST (Magnetic Secure Transmission), making it compatible with more types of payment terminals.

- PayPal: While primarily known for online payments, PayPal can also be used for in-store payments at participating retailers.

- Other Wallets: Other apps like Cash App, Venmo, and Stripe allow you to link a credit card to your phone for peer-to-peer transactions and online purchases.

2. Add Your Credit Card to the Mobile Wallet

Once you’ve selected a payment app, the next step is to link your credit card to the app. Here’s how to do it for Google Pay, one of the most popular mobile wallets:

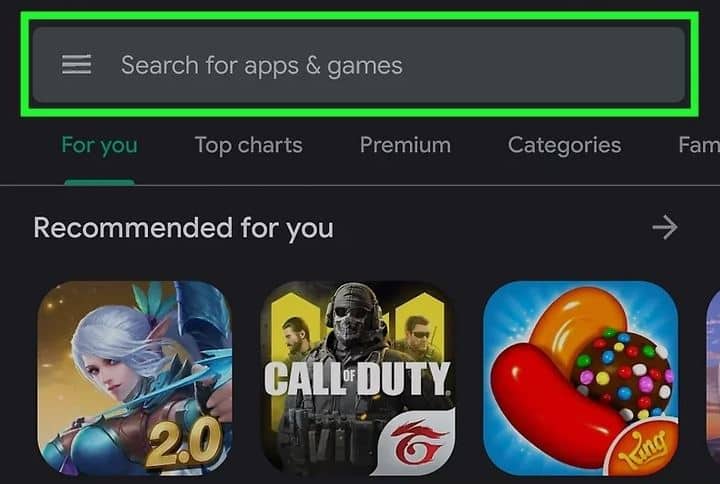

- Open the Google Pay App: Download the Google Pay app from the Google Play Store if you don’t already have it installed.

- Set Up Google Pay: Open the app and sign in with your Google account. Follow the prompts to add a payment method. You’ll typically need to provide your credit card number, expiration date, and CVV.

- Verification: After entering your card details, the app will verify your information by sending a code to your phone or email. Enter the code to complete the setup.

- Set as Default Payment Method: If you plan on using your Android phone as your primary payment method, set Google Pay as your default payment option for transactions.

3. Activate NFC for Contactless Payments

Ensure that NFC (Near Field Communication) is enabled on your phone to make contactless payments at stores. This is typically turned on by default, but here’s how to double-check:

- Go to Settings on your Android phone.

- Tap on Connected Devices or Connections.

- Select NFC and ensure the toggle is turned on.

With NFC enabled, your phone is ready to make contactless payments by simply tapping it on an NFC-enabled payment terminal.

4. Start Making Payments

Once your payment app is set up and NFC is enabled, you’re ready to start making purchases. Here’s how to use your Android phone as a credit card:

- In-Store Payments: When you’re ready to pay, open the mobile payment app (such as Google Pay), unlock your phone, and hold it near the payment terminal. The terminal will automatically detect the NFC signal and process the payment. You might need to authenticate the payment using a PIN, fingerprint, or face recognition, depending on your phone’s settings.

- Online Payments: When shopping online, choose the payment option to pay with Google Pay, Samsung Pay, or another linked wallet. The app will automatically fill in your payment details, and you may only need to confirm the transaction with your fingerprint or PIN.

- Peer-to-Peer Payments: For sending money to friends or paying for services, you can use apps like Google Pay, PayPal, or Cash App. Simply select the recipient, enter the amount, and confirm the payment.

Advantages of Using Android as a Credit Card

Using your Android phone as a credit card offers several significant advantages:

1. Convenience

Having your credit card on your phone means you no longer need to carry a physical card with you. You can make payments anywhere that accepts contactless payments, from retail stores to online shops, all with just your phone. This eliminates the hassle of digging through your wallet or purse for your card.

2. Security

Android-based payment systems use encryption and tokenization to keep your card information safe. Even if your phone is lost or stolen, the payment apps often require biometric authentication (fingerprint or face recognition) or a PIN before allowing any transaction. This makes it much harder for unauthorized users to access your financial information.

3. Faster Transactions

Contactless payments are faster than traditional methods, such as inserting or swiping a card. Simply tapping your phone on the payment terminal is all it takes, making transactions quicker and more efficient.

4. Track Your Spending

Most mobile wallet apps have features that allow you to track your spending. You can monitor your transactions, view your balance, and receive notifications about purchases, making it easier to stay on top of your finances.

5. Loyalty Cards and Rewards

Many mobile payment apps allow you to store loyalty cards and redeem rewards directly from the app. This means you can earn points, cashback, or discounts with a simple tap of your phone, all without needing to carry physical cards.

Security Considerations

While using Android as a credit card offers enhanced security compared to carrying physical cards, it’s important to follow some best practices to ensure your information stays protected:

- Enable Two-Factor Authentication: For added security, enable two-factor authentication (2FA) on your mobile payment app. This will add an extra layer of protection when making transactions.

- Use Strong Screen Lock: Protect your phone with a strong PIN, password, or biometric lock (fingerprint or facial recognition) to prevent unauthorized access.

- Monitor Your Accounts: Regularly check your payment app and bank statements for any unauthorized transactions. Most apps also offer instant notifications when a payment is made, helping you quickly detect fraudulent activity.

- Lost or Stolen Phone: If your phone is lost or stolen, immediately lock it remotely and disable access to payment apps. Both Google and Samsung provide options to remotely lock or wipe your phone.

Conclusion

Using Android as a credit card is a convenient, secure, and efficient way to manage your payments. By leveraging NFC technology and mobile payment apps, you can make purchases anywhere, track your spending, and enjoy enhanced security features. Whether you’re making a quick purchase in-store, paying bills online, or sending money to friends, your Android phone can serve as a virtual credit card, making your financial transactions smoother and more accessible. By following the simple setup process and maintaining good security practices, you can turn your Android device into a powerful payment tool.