Signing a credit card is an essential yet often overlooked step in the process of activating and using your card. While many people are familiar with the practice of signing credit card receipts at the checkout counter, fewer are aware of the importance of signing the card itself. A signature on your credit card is not only a security measure but also an essential element for activating your card and protecting you against fraud. In this comprehensive guide, we’ll explain why signing your credit card is important, how to do it correctly, and the security considerations to keep in mind when handling your credit card.

Why Should You Sign a Credit Card?

At first glance, it might seem like a trivial step, but signing your credit card is actually an important part of both security and legal usage. Here’s why:

1. Security and Fraud Prevention

Signing your credit card provides an additional layer of security by making it harder for someone to use your card if it’s lost or stolen. If a cardholder’s signature on the back of the card does not match the signature on the receipt or any other related documents, it can serve as a red flag for fraud. This feature is particularly useful in physical transactions, where a signature is often required as proof of authorization.

2. Activation of Your Card

In most cases, credit card companies will require that you sign your card before it can be used for transactions. In fact, the signature is often required to be completed in order for your card to be activated properly. Without a signature, your card might not be recognized as valid when you attempt to use it for in-store purchases or at ATMs. Therefore, ensuring your card is signed is necessary to start using it.

3. Credit Card Issuer Policies

Many credit card issuers specifically include a “signature field” on the back of the card, and they require the cardholder to sign it in order to comply with their terms of service. Signing the card helps the issuer identify the legitimate cardholder, ensuring that you’re the authorized user. If you don’t sign your card, the issuer may consider it invalid or unauthorized for use.

4. Legal Protection

In the event of a dispute or fraudulent activity on your account, your signed credit card can serve as proof that the cardholder is legitimate. For example, when making a purchase or filing a chargeback claim, a merchant or bank may ask for the signature on your card to verify that it matches the one on the receipt. This step can help to resolve disputes and ensure you are protected against fraudulent charges.

5. Cardholder Identification

In certain situations, merchants may ask you to sign receipts or provide identification when using your credit card, especially if the amount is large or if the transaction is unusual. A signature on your card ensures that the merchant can cross-check your identification and verify that you are indeed the cardholder.

How to Sign Your Credit Card Correctly

Now that you understand why signing your card is important, let’s walk through how to do it correctly.

1. Use a Pen with Permanent Ink

When signing your credit card, it’s best to use a pen with permanent ink, such as a ballpoint pen, to ensure that your signature remains intact. Avoid using erasable pens, which can easily be altered or removed.

2. Sign Your Name Consistently

When signing your card, it’s important to use the same signature that you would use for other financial transactions, such as signing checks or receipts. This helps ensure that your signature is consistent and can be matched to the one on file with your credit card issuer, preventing potential issues during card verification.

- Consistency is Key: The way you sign your card should reflect your usual signature style. It doesn’t have to be identical to your signature on every document, but it should have the same basic characteristics (e.g., same initials, similar flow).

3. Write Clearly

While your signature doesn’t need to be perfectly legible, it should be clear enough to identify that it’s your signature. Avoid scribbling or drawing abstract marks. A clear, readable signature ensures there is no confusion if the card needs to be verified.

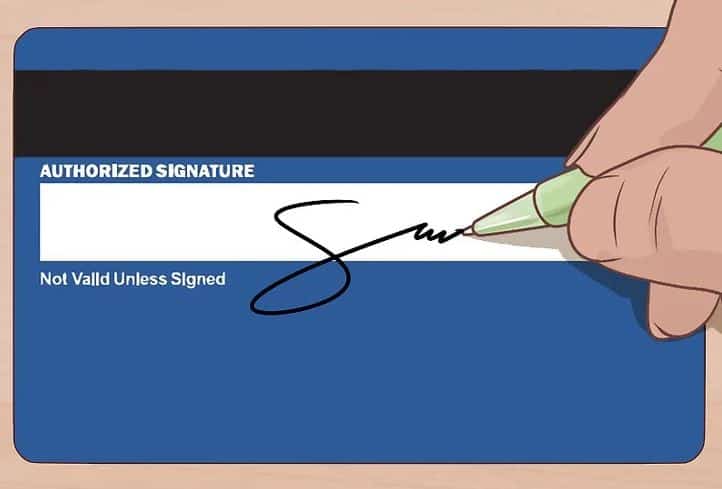

4. Sign in the Designated Space

On the back of your credit card, there will usually be a small signature strip or a signature panel. This area is specifically designated for your signature. Make sure to sign in the space provided, and avoid writing over any card information like the card number or expiration date. Signing in the designated area helps avoid any issues with card verification.

5. Don’t Overwrite the Card Number

If your card has a printed card number near the signature field, be careful not to overwrite or obscure the card number with your signature. Doing so could make it harder to read the card details in case of a dispute or fraud investigation.

6. Consider Signing on the Front for Security

While traditionally the signature is placed on the back of the card, some credit card companies now offer the option of signing the front of the card, typically on the right side where there is a dedicated space. If you have a card with such an option, consider signing on the front of the card to add an extra layer of security. This way, your signature will be easily visible to merchants, making it more difficult for a thief to use your card without detection.

What Happens if You Don’t Sign Your Credit Card?

Not signing your credit card can result in several potential issues:

- Limited Usability: If your credit card is not signed, it may not be accepted at all by some merchants, especially those who require a signature verification. Some merchants may refuse to process the payment or may ask you to sign the card before proceeding.

- Loss of Protection: If your card is lost or stolen and you haven’t signed it, you could have a harder time disputing fraudulent charges. Banks and card issuers may treat a card without a signature differently from one that is signed, possibly leaving you more vulnerable to fraud.

- Invalid Card: Certain credit card issuers may not allow you to activate or use your card until it has been signed. If you fail to sign your card, it may remain inactive, and you may not be able to use it for purchases or withdrawals.

- Rejection by Some Merchants: In rare cases, merchants may refuse to process transactions if the signature on the card is missing, as it can raise concerns about the legitimacy of the transaction. In such cases, you may be asked to sign the card before the transaction can proceed.

How to Handle a Lost or Stolen Credit Card

If you’ve lost your credit card or it has been stolen, your signature is one of the few forms of identification that can protect you from fraud. Here’s what you should do:

- Contact Your Credit Card Issuer Immediately: If your card is lost or stolen, report it to your credit card issuer as soon as possible. Most card issuers have a 24/7 customer service line for emergencies, including reporting lost or stolen cards. They will block your card and issue a replacement.

- Monitor Your Account: Regularly check your account for any unauthorized transactions. If you spot any fraudulent activity, alert your card issuer immediately. They will usually conduct an investigation and may reverse any unauthorized charges.

- File a Fraud Report: In some cases, your credit card issuer may require you to file a fraud report. This report will document the loss or theft and may help you avoid being held responsible for any fraudulent charges.

- Request a New Card: If your card is lost or stolen, request a new card. Ensure that the new card is signed upon receipt, and activate it as soon as possible.

Digital Signatures for Online Transactions

While signing the physical card is essential for in-store purchases, the digital signature is becoming increasingly important for online transactions. Many online retailers and service providers now require digital signatures or authentication steps to verify your identity when making a purchase.

- Secure Payment Gateways: Some credit card companies now use digital signatures or tokenization technologies for online transactions to protect your information. Digital signatures help ensure that the person making the purchase is the legitimate cardholder, reducing the risk of fraud.

- Use of CVV and 3D Secure: Many credit card issuers also require the use of the card’s CVV (Card Verification Value) or additional authentication methods, such as 3D Secure (e.g., Visa Secure or Mastercard Identity Check), when making online payments. These methods ensure that even if a hacker gets hold of your card information, they will still need to authenticate the transaction.

Conclusion

Signing your credit card may seem like a small task, but it plays a crucial role in protecting you from fraud and ensuring that your card is properly activated for use. The signature serves as a security feature, protects against unauthorized usage, and helps you in the case of disputes or chargebacks. By signing your card correctly and following the best practices outlined in this guide, you can help safeguard your credit card information and ensure a smoother, safer payment experience. Always remember to treat your signed card as a valuable piece of financial equipment and take necessary precautions to avoid loss or theft.