Receiving a new credit card in the mail can be exciting, as it often represents an opportunity for financial flexibility, rewards, and improved credit. However, before you can use your new card, you must activate it. Credit card activation is a vital step in ensuring that the card works properly, is tied to your account, and is secure. This process varies slightly depending on the issuer, but understanding how to activate your credit card, why it’s important, and the steps involved can help you avoid unnecessary confusion or delays.

In this guide, we’ll walk you through the process of activating your credit card, why it’s important, the different activation methods, and some essential security tips to keep in mind during the activation process.

Why Activating Your Credit Card is Important

When you first receive your credit card, it’s typically deactivated for security reasons. This means that the card cannot be used for any transactions until it is activated. Here are the key reasons why activating your card is necessary:

- Account Validation: Activating your card confirms that you received the card and ensures it is tied to your account with the card issuer. This step is a form of verification to make sure that the card reaches the correct person.

- Security: Activation helps secure your card by confirming that you are the intended user. It also helps prevent unauthorized use in case someone intercepts the card during delivery.

- Protecting Against Fraud: Activating your card also typically involves verifying your identity through methods such as a PIN, security question, or biometrics. This ensures that the card is not used by anyone other than the legitimate cardholder.

- Unlocking Card Benefits: Many credit cards offer rewards, cashback, or promotional offers that are only available once the card has been activated. Failure to activate your card means you might miss out on these benefits.

- Ensuring Proper Functionality: Some credit card issuers will require activation before your card is ready to make purchases. Activating the card ensures that it’s properly linked to your account and all features are enabled.

Methods of Activating a Credit Card

Most credit card companies offer several ways to activate your card, making it convenient and fast for cardholders to get started. Here are the most common methods for activating your new credit card:

1. Activating Your Credit Card Online

Many card issuers allow you to activate your card online through their website. This is often the quickest and easiest method, and it can be done from any device with internet access. Here’s how you can activate your credit card online:

- Step 1: Visit the card issuer’s website. Go to the official website of your credit card issuer and locate the “Activate” section, often found on the homepage or in the account management section.

- Step 2: Log in to your account. You’ll need to enter your username and password to access your account. If you haven’t set up an online account yet, you may need to register first by providing your card number and other personal details.

- Step 3: Enter the card details. You will be asked to provide the card number, expiration date, and possibly the CVV (Card Verification Value) or security code (usually found on the back of the card).

- Step 4: Verify your identity. The website may ask for additional information to verify your identity, such as your date of birth, the last four digits of your Social Security number, or answers to security questions.

- Step 5: Confirm activation. After entering all required information, you should receive confirmation that your card is successfully activated and ready to use.

2. Activating Your Credit Card by Phone

If you prefer to activate your card by phone, most credit card issuers offer this option as well. Here’s how you can activate your card over the phone:

- Step 1: Find the activation phone number. You’ll typically find a phone number for activation on the sticker that comes with your new card. This is a toll-free number dedicated to card activation.

- Step 2: Call the number. Dial the provided activation number. You will likely hear an automated voice prompt guiding you through the process.

- Step 3: Provide your card details. You will be asked to enter your credit card number, the expiration date, and the security code (CVV). Some systems may also request additional personal information, such as your name, date of birth, or Social Security number.

- Step 4: Confirm activation. After verifying your information, the system will confirm that your card is activated. You may hear a message indicating that the card is now ready for use.

- Step 5: Follow any additional instructions. Some issuers may provide further instructions, such as setting up a PIN for your card or confirming your contact information.

3. Activating Your Credit Card via Mobile App

Many credit card issuers have mobile apps that allow you to manage your account, make payments, and activate your card. Here’s how to activate your credit card using an app:

- Step 1: Download the app. If you haven’t already, download the official mobile app of your card issuer from the Apple App Store (for iOS devices) or Google Play Store (for Android devices).

- Step 2: Log into your account. Open the app and log in using your account credentials. If you don’t have an account, you may need to register and provide your card details.

- Step 3: Find the activation option. Look for the option to activate your card, which should be clearly visible on the main screen or in the account settings.

- Step 4: Enter card details. Enter your card number, expiration date, and CVV, and follow any additional prompts to verify your identity.

- Step 5: Confirm activation. After completing the process, you should receive confirmation that your card has been successfully activated.

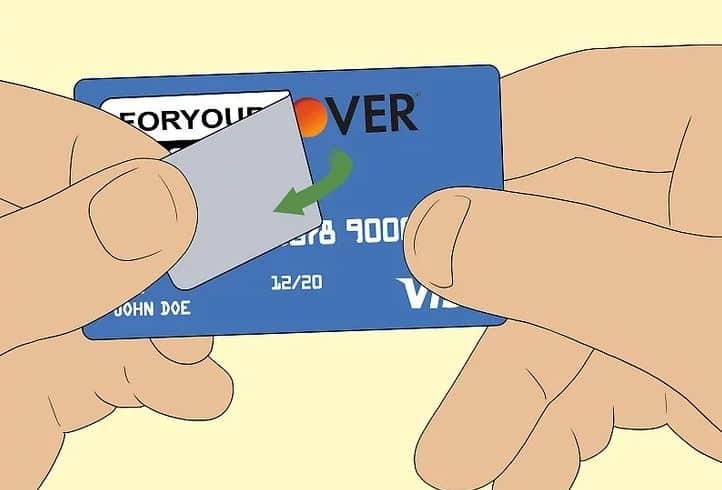

4. Activating Your Credit Card Through Mail (Less Common)

While the online, phone, and app methods are by far the most common, some credit card issuers may still offer an activation method by mail. This process usually involves returning a verification form or signing a card that was sent to you along with your credit card. This method is becoming less common due to its time-consuming nature and potential security risks.

Additional Security Measures During Activation

When activating your credit card, it’s essential to follow certain security measures to protect your information:

- Use Secure Websites and Apps: Ensure that the website or app you’re using is legitimate and secure. Look for “https://” in the URL and a padlock symbol in the browser’s address bar. These indicate that the site uses encryption to protect your data.

- Avoid Public Wi-Fi: It’s advisable not to activate your card over public Wi-Fi networks, as they may not be secure. Use a secure home network or mobile data instead.

- Set Up Multi-Factor Authentication (MFA): Many credit card issuers offer the option of setting up multi-factor authentication during the activation process. This may include receiving a one-time code via text or email, or using biometric authentication (like fingerprints or facial recognition) on your mobile device.

- Create a Strong PIN and Password: If you’re required to set up a PIN or account password during the activation process, make sure to choose a strong, unique combination that’s hard for others to guess.

What Happens After Activation?

Once your credit card is activated, you can begin using it immediately, depending on the issuer. Here’s what typically happens after activation:

- You Can Make Purchases: You can now use your credit card to make in-store and online purchases, as well as withdraw cash at ATMs (if your card supports cash advances).

- Receive Your First Statement: Once activated, your credit card issuer will begin generating monthly statements. Be sure to monitor these for any unauthorized charges and always make at least the minimum payment by the due date to avoid fees and interest.

- Activate Card Features: Some credit cards may offer additional features, such as rewards, cashback, or travel perks. Activation may unlock access to these benefits, so check with your issuer about how to enroll in these programs.

- Security Alerts: Some card issuers may send you alerts via text, email, or app notifications to confirm that your card has been activated. This is a good way to ensure that no one else has activated your card fraudulently.

Troubleshooting Common Activation Issues

Sometimes, issues can arise during the activation process. Here are some common problems and solutions:

- Incorrect Information: Double-check that you’re entering the correct card number, expiration date, and CVV. If the information doesn’t match what’s on file, activation may fail.

- Card Not Activated Yet: If you just received your card and it isn’t working yet, give it a few minutes. Some issuers may require a short delay after activation before the card is fully functional.

- Activation Fails: If you continue to have trouble activating your card, try using another method (e.g., online vs. phone). If the issue persists, contact your card issuer’s customer service team for assistance.

Conclusion

Activating your credit card is a crucial first step in ensuring that your new card is ready to use and secure. Whether you choose to activate your card online, over the phone, or via a mobile app, the process is generally quick and straightforward. Just remember to follow security best practices to protect your personal information during activation. Once activated, you can start enjoying the benefits of your credit card—whether it’s for making purchases, earning rewards, or building your credit score.