In today’s digital world, credit cards have become a critical component of our financial lives, particularly for online transactions. With the rise of e-commerce, digital payments, and mobile banking, using a credit card online has become more convenient, secure, and essential than ever before. Whether you’re shopping for products, subscribing to services, or even making investments, your credit card plays a central role in facilitating these transactions. But how does it work? What are the benefits and risks? And how can you ensure that your credit card usage online remains secure?

In this guide, we will explore all aspects of using a credit card online, from how to use it safely to the advantages it offers, and even some alternatives that are gaining traction in the digital space.

How Credit Cards Work Online

Credit cards function as a method of borrowing from a financial institution to make purchases or payments. When you use a credit card online, the payment process typically involves three key components:

- Initiating the Transaction: When you shop online and select an item or service to purchase, you proceed to checkout. You will be asked to enter your credit card details, such as your name, card number, expiration date, and security code (CVV), typically found on the back of the card.

- Authorization: Once your card details are submitted, the merchant sends the transaction request to the card issuer, which is the bank or financial institution that issued your credit card. This process involves checking the validity of your card, verifying your account balance, and ensuring that you have enough credit available to make the purchase.

- Payment Completion: After the transaction is authorized, the amount is charged to your credit card, and the merchant ships the product or provides the service. If you’re using your card to subscribe to a service, the subscription fee will be billed monthly or annually, depending on the terms.

This is the basic process for any online credit card transaction, whether you’re buying a product, paying for a service, or making a donation. The speed and ease of this process are what make credit cards an ideal choice for online payments.

Benefits of Using a Credit Card Online

Using a credit card online has many advantages, particularly in terms of convenience, security, and rewards. Let’s take a look at the primary benefits:

1. Convenience and Accessibility

The most apparent benefit of using a credit card online is the convenience it offers. Whether you’re shopping from home, buying a gift for a friend, or paying for a subscription, you can do it all from your phone, tablet, or computer with a few clicks. Online payments are generally faster than traditional methods like writing checks or transferring funds through a bank, and they eliminate the need to carry cash or visit physical stores.

2. Security Features

Credit card issuers invest heavily in security technologies, ensuring that transactions made online are as safe as possible. Some of the most common security measures include:

- Encryption: Online transactions use encryption technologies to protect sensitive data during transmission. This ensures that your credit card information is unreadable to anyone attempting to intercept it.

- 3D Secure Authentication: Many credit cards support 3D Secure (like Verified by Visa or MasterCard SecureCode), an additional layer of authentication during the checkout process. This involves entering a one-time password (OTP) or using biometric identification to verify your identity.

- Fraud Protection: Credit card issuers often offer fraud protection services that monitor your account for suspicious activity. If unauthorized transactions are detected, they may notify you and reverse the charges.

- Chargebacks: One of the most significant advantages of using a credit card online is the ability to dispute charges. If a merchant fails to deliver goods or services or if you are charged for a product you didn’t purchase, you can file a chargeback, and the credit card company will investigate and often refund the transaction.

3. Rewards and Benefits

Many credit cards offer rewards programs, which can be highly beneficial when shopping online. Depending on the card, you can earn cashback, points, miles, or other incentives for every dollar you spend. Some cards even provide special bonuses for purchases made on specific categories, such as online shopping, travel, or dining.

Additionally, many credit cards offer exclusive online deals and discounts, especially if you shop with partner merchants. Some cards also provide extended warranties or purchase protection, which can be valuable when buying high-ticket items online.

4. Credit Building

Using your credit card responsibly, such as making on-time payments and keeping your balance low, can help you build your credit. A good credit score improves your financial standing and can lead to better loan terms, lower interest rates, and a higher credit limit. By using a credit card for online purchases and paying off the balance, you can demonstrate your creditworthiness to lenders.

Common Online Payment Methods and How Credit Cards Compare

While credit cards are still the most common way to make online payments, several alternatives have emerged in recent years. Here’s how credit cards compare to other popular online payment methods:

1. Digital Wallets (e.g., PayPal, Apple Pay, Google Pay)

Digital wallets like PayPal, Apple Pay, and Google Pay allow users to store their credit card information securely and make online payments with just a few clicks. They are often favored for their convenience and speed.

- Advantages: Digital wallets often offer an additional layer of security, as they don’t expose your actual credit card number during transactions. Instead, they generate a unique transaction code for each purchase.

- Disadvantages: While digital wallets can make transactions faster and more secure, they still rely on linking to a credit card, meaning you’re ultimately using a credit card for the purchase. Additionally, not all merchants accept digital wallets, so there may be limitations.

2. Cryptocurrency

Cryptocurrencies like Bitcoin and Ethereum are gaining popularity as an alternative payment method for online transactions, especially with merchants in the tech, gaming, and digital goods sectors.

- Advantages: Cryptocurrencies offer the potential for lower transaction fees, increased anonymity, and faster cross-border payments. They are also decentralized, meaning no central authority oversees the transactions.

- Disadvantages: The value of cryptocurrencies can be highly volatile, and not all online stores accept them. Additionally, the process of purchasing and converting cryptocurrencies can be complex for the average consumer.

3. Bank Transfers and Debit Cards

Some people prefer to make online purchases directly from their bank account or with a debit card, which deducts the funds immediately.

- Advantages: Bank transfers and debit cards don’t involve borrowing money, so you’re spending money you already have. This can be helpful for those trying to avoid credit card debt.

- Disadvantages: Unlike credit cards, debit cards don’t offer the same level of fraud protection. Additionally, they often don’t come with rewards or other perks that credit cards offer.

How to Use Credit Cards Safely Online

While credit cards offer security features to protect you, there are several best practices you should follow to ensure your card remains safe during online transactions:

1. Shop on Trusted Websites

Only shop on websites that you trust and that use secure connections (look for “https” in the URL). Avoid clicking on suspicious links or shopping on unknown sites, as these can be breeding grounds for phishing attacks and fraud.

2. Monitor Your Statements Regularly

Make a habit of reviewing your credit card statements regularly to spot any unauthorized charges. If you notice anything suspicious, report it to your card issuer immediately.

3. Use Strong Passwords and 2-Factor Authentication

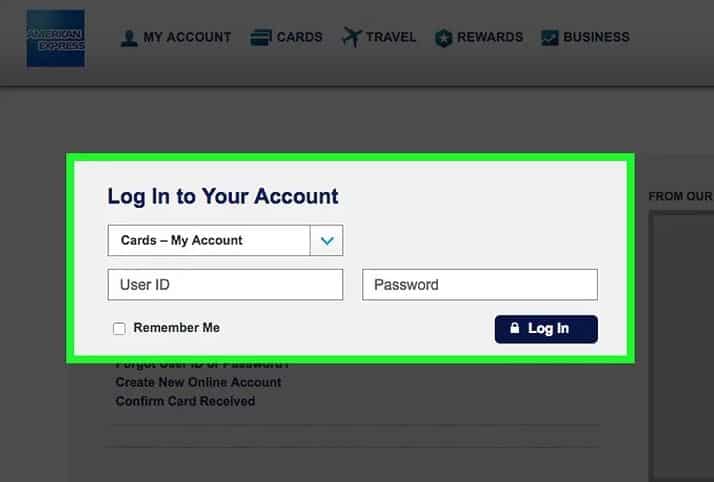

When creating accounts on online shopping platforms, always use strong, unique passwords. Enable 2-factor authentication (2FA) if available to provide an additional layer of security.

4. Avoid Public Wi-Fi for Financial Transactions

Avoid entering your credit card information over public Wi-Fi networks, as they are often unsecured and can be exploited by hackers. Use a secure, private internet connection, or consider using a Virtual Private Network (VPN) for added protection.

5. Enable Transaction Alerts

Most credit card issuers offer transaction alerts, which send notifications via text or email whenever your card is used. Enable this feature so you can quickly detect any unauthorized transactions.

Common Issues with Using Credit Cards Online

Despite their many advantages, using credit cards online can present some challenges. Here are some common issues you may encounter:

- Rejected Transactions: Sometimes, online merchants may decline your credit card transaction, especially if the billing address doesn’t match the one on file with your issuer, or if the transaction is flagged as suspicious. Double-check your details and contact your issuer if necessary.

- Online Fraud: Although credit card issuers provide fraud protection, there’s always a risk of identity theft, phishing scams, or fraudulent websites. Always use caution when entering sensitive information online.

- Hidden Fees: Some online merchants, especially international ones, may charge extra fees for processing credit card payments, such as foreign transaction fees or currency conversion charges. Always check the terms before completing a purchase.

Conclusion

Credit cards remain one of the most popular and secure ways to make online purchases, providing convenience, security, and valuable rewards. However, it’s crucial to understand the risks and take the necessary steps to protect your financial information when shopping online. By following best practices like shopping on trusted websites, using strong passwords, and monitoring your transactions, you can ensure that your online credit card usage remains safe and secure.

In the future, as digital payments continue to evolve, credit cards will likely remain at the forefront of online transactions, complementing other methods like digital wallets and cryptocurrencies. For now, understanding how to use credit cards effectively and securely online is key to enjoying the full benefits of the digital economy.